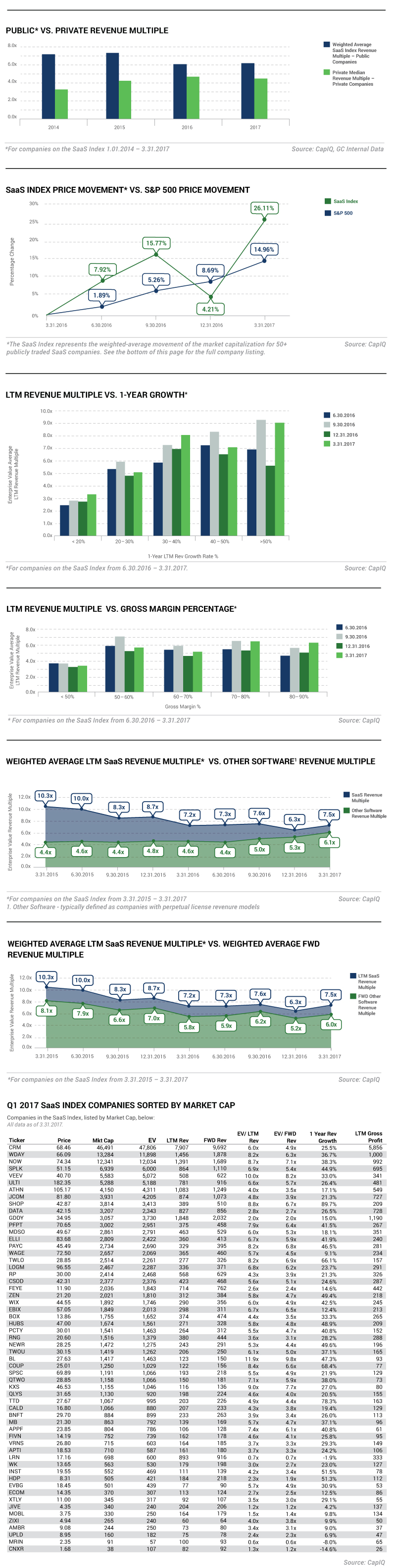

Welcome to the ninth edition of QuEST, which

presents valuation and investment trends for SaaS companies during Q1 2017. QuEST utilizes data from

both private companies and publicly traded companies referred to as the “SaaS Index.” The SaaS Index

represents the weighted-average movement of the market capitalization for over 50 publicly traded

SaaS companies.

A

CONVERSATION WITH HOST ANALYTICS, INC. AND GOLUB CAPITAL

For

this edition, Golub Capital’s Peter Fair

interviewed Ian Charles, Chief Financial Officer of Host Analytics, Inc.

For

this edition, Golub Capital’s Peter Fair

interviewed Ian Charles, Chief Financial Officer of Host Analytics, Inc.

Peter: Hi Ian. Thanks so much for joining us today. I’m looking forward to chatting about your experience at Host Analytics. To start, tell us about being a venture-backed technology business in 2017. Have you noticed any changes in consumer buying trends and behaviors?

Ian: Hi Peter, thanks for having me. Heading into the second half of 2017, we see customers requiring a higher

degree of diligence in the financial stability of any vendor partnership they enter into. However, we also continue to see customers voting with their wallet and not turning to solution providers simply because of price. There is a growing focus on not only finding a solution to current business problems, but also a solution that scales with those issues that arise in the future. This has become an added requirement for a vendor.

Peter: There has been volatility in valuations in recent years; how has that impacted/affected your experience?

Ian: The recent volatility has shaken out some of the weaker players. This has resulted in additional pressure to perform in secondary metrics that include net revenue retention, LTV, growth efficiency index, etc. It’s no longer about top line growth, it’s about the true underlying long term value of that growth and the profitable sustainability.

Peter: How are you thinking about new services, and increasing adoption and/or entry into new markets?

Ian: We are constantly advancing our thoughts and progress towards new features and products that are mission critical to the finance function within Enterprise Performance Management. Our efforts include expanding go-to-market partnerships with companies like Workiva and Sage in addition to the expansion of channel partnerships with Deloitte, Accenture and RSM.

Peter: If you were talking to a group of medium and small software company CEOs, name two things you’d say they should focus on.

Ian: One. Hire the best people who can execute, execute, execute. Two. Don’t think about the current quarter---let your team handle that. Think about where you want to be next year.

Sign up for the QuEST mailing list: